Fund

Takeaways from this page

- Our 60 year young Fund … and why smaller companies are speedboats

- Our genuine unique approach

- Why hundreds of investors have trusted us

- How you can invest … and grow your money too

Our Fund

We manage the Sterling Select Companies Fund – a UK UCITS which holds a portfolio of diverse businesses.

We invest in overlooked, under-researched and mispriced companies.

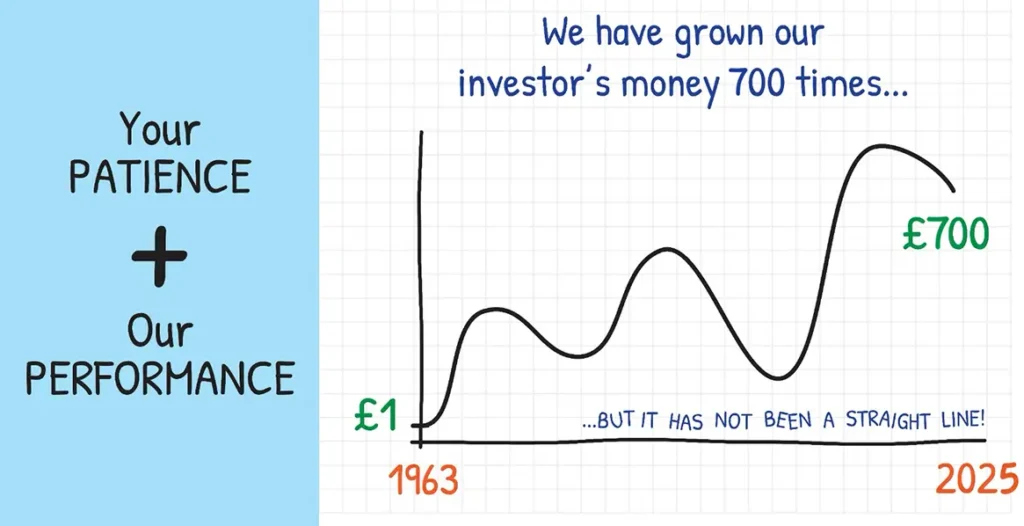

After deducting all fees, an investment of £1,000 would have grown to more than £600,000. That is 600 times the initial outlay >>>

The open-ended fund structure means

- No discounts to net asset value

- No exit fees or early redemption fee

- No lock-ins. You can get your money back – when you want it

The Fund has a proven track record since 1963

We are investors in the Fund.

We are keen to attract like minded investors to invest but only after they have fully understood our what, how and why.

Investment Process

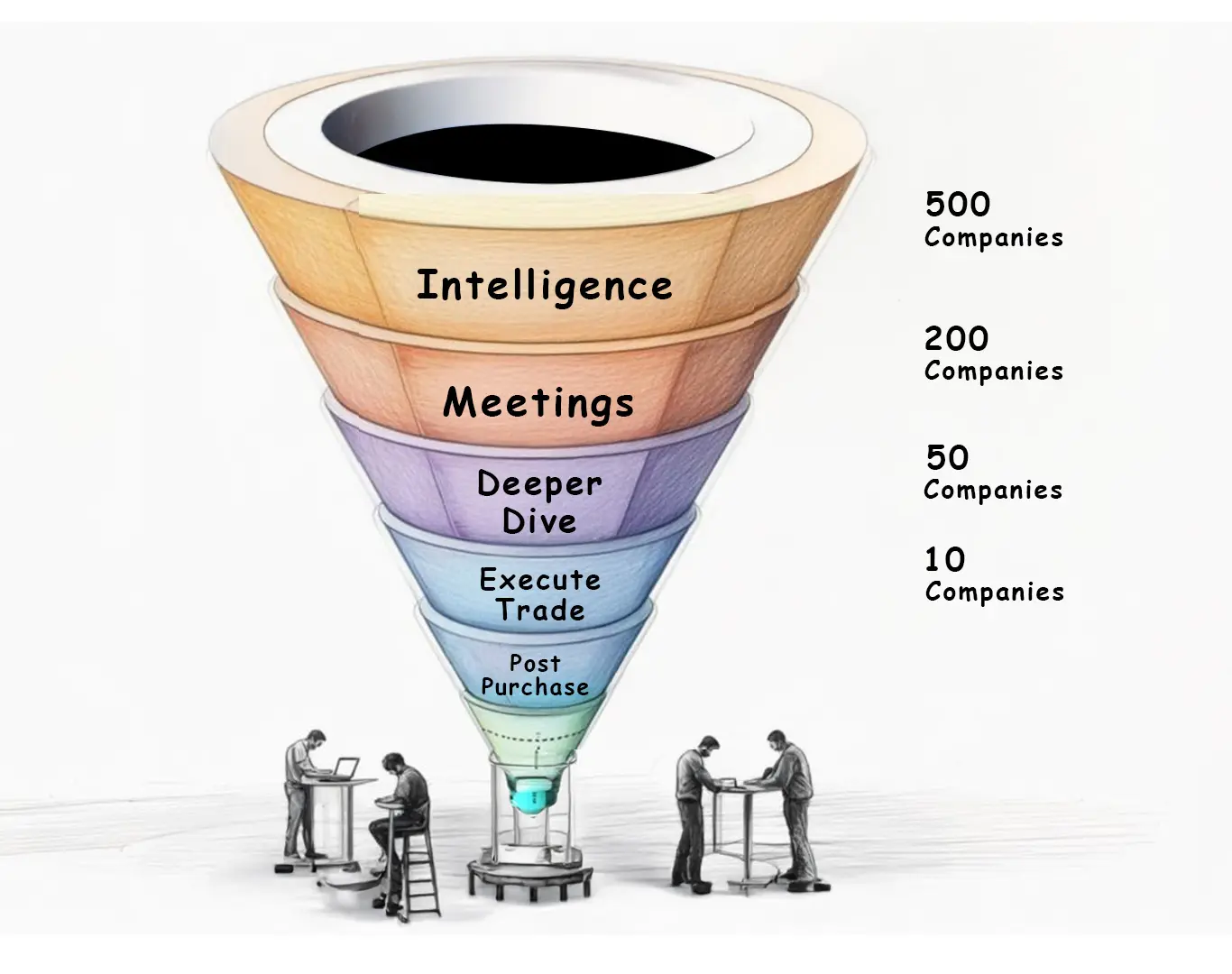

There are no short cuts to success

-

Intelligence gathering: We scan the relevant industries for growth, RoCE etc. We then study company filings and analyst reports and go beyond that.

-

Every year, we meet hundreds of companies but purchase just a few. We buy to keep; we think and act like owners.

-

Our Fund is one of UK’s oldest funds and is living proof that active investing i.e. stock picking works.

People we trust

Business is all about people; we invest only in people we trust and admire.

Purposeful business

Our portfolio companies serve our society and make this world a better place.

Hidden gems

We deliberately seek overlooked companies that are below the radar of larger institutional funds.

We are conscious of valuations and Margin of Safety.

We seek an attractive entry valuation and then be patient for the re-rating to unfold.

We are fussy and do not follow the crowd.

Proof ? Our distinct portfolio reflects our independent thinking.

Compare our Fund holdings yourself and see the difference first-hand.

Other Reasons

Why hundreds of investors have invested in the Fund ?

Liquidity

The UCITS open-ended structure allows daily dealing. Investors never suffer from NAV discounts as in investment trusts.

Governance

The Fund is FCA regulated and has multiple layers of oversight: ACD, Custodian, Trustees and its own Board of Independent Directors.

Performance + Access

Our wide network allows us access to interesting opportunities including IPOs, discounted placings, liquidity events and blocks of shares.

We... do not

It is also important that you know ... what we do not do.

Never try to be clever

We do not attempt to time the market.

Our style does not involve clever algorithms or other forms of black magic.

Never copy the index

We do not hide behind any index.

We apply our mind and carefully study each company, one at a time.

Never charge hidden fees

There are no hidden fees, no entry fees or exit fees. We do not charge a performance fee either.

Never compromise

We do not invest in businesses we do not understand. We stay away from get-rich offers and popular companies.

Investing in smaller companies

-

In general, larger companies have a dedicated investor relations team and their website contains exhaustive information. Hence, hundreds of analysts and large fund houses find it very easy to research them – from the comfort of their desks. Who would object to such a cushy job? Unfortunately, this also makes larger company investing a very crowded endeavour. It is incredibly hard to develop any sort of edge.

-

In the post-MiFID-2 world, many brokers have cut their research coverage of smaller companies. This relative lack of analysis on smaller companies means they are more likely to be overlooked and possibly underpriced. We welcome such inefficient pricing and believe we are paid to do just that.

-

Smaller companies are hard work. Fact. Fortunately, we love what we do and this gives us the required energy to turn over one more rock and find the next hidden gem.

Undervalued

Often, smaller companies are under-researched and overlooked. This often results in undervaluation which works in our favour.

Takeover candidates

Larger companies acquire smaller companies – especially if the stock market fails to value them correctly. Several of our companies have been acquired at significant premiums.

Ownership mindset

Often, the management of smaller companies have meaningful shares, more aligned with shareholders. As owners, they are careful – just like us. We like that.

Speedboats

Generally, smaller companies are more focused and simpler businesses. Smaller companies grow faster than larger ones; they are speedboats, not super tankers.

Aligned teams

We get to know the senior management team, evaluate the culture of the company and the commitment of the team.

Discounted shares

We are able to invest in IPOs and discounted share placings. Our strong relationships with brokers and company executives translate into desired allocations.

How to invest

Invest directly

Through our friendly UK based fund administrators.

Following steps are required for only the first time.

-

Download the application form (regular or ISA)

-

Fill in a simple form (no additional documents are required)

-

Make payment using a direct bank transfer (only to the account mentioned in the form and no other)

-

Post the form to Yealand Fund Services, Stuart House, St John’s St, Peterborough PE1 5DD

Platforms

Search for *YFS Sterling Select Companies Fund* on any good platform.

If your preferred platform does not have our Fund enlisted, please let us know and we can get working!

Also featured in

Fund History : 60 but young at

A quick history for the enthusiast.

Greene & Company were stockbrokers in 1960’s. They created a collective vehicle for their private clients in 1963, the same Fund we continue to manage today.

- Greene was acquired by Greig Middleton which then became Gerrard Limited.

- Gerrard became a public company in 1962 (it claimed a history of more than 200 years).

- Capel Cure Sharp (then owned by Old Mutual) acquired Gerrard in March 2000 in a deal worth £525 million !

Gerrard is also mentioned in two of the volumes of David Kynaston’s classic multi-volume history of the City of London, available at the Barbican Library (definitely worth a read about London Financial history). It is doubtful if there is any city in the world, including New York, that can match London’s very rich financial history.

In 2003, Barclays Bank acquired the broking business from Old Mutual plc.

As of 2025, the Fund is the 18th oldest fund in the UK. The Fund was born in 1963 and has turned 61… we have 39 to go before we score 100.